It’s a rare phenomenon to see money management discussions around parenthood and only 20 percent of the parents are able to talk about money with their kids. These kinds of conversations inculcate lifelong lesson in kids about self-reliance, work ethic and financial literacy.

If you are giving your child away money, make sure it is aligned with a certain action. It’s very crucial to talk to your child about saving and budgeting and how to achieve that in the short and long term. For example, curbing smaller day-to-day purchases like ice-creams or snacks can let them buy something bigger— a new bike or even a car.

Tell your kids why you can’t just rush to the store every time they want something. By the time kids reach their second grade, they are not only impulsive buyers but also curious about how much their new Lego set or a frozen toy cost. But however, most of fiscal resourcefulness of a 7-8 year old only involves asking for money.

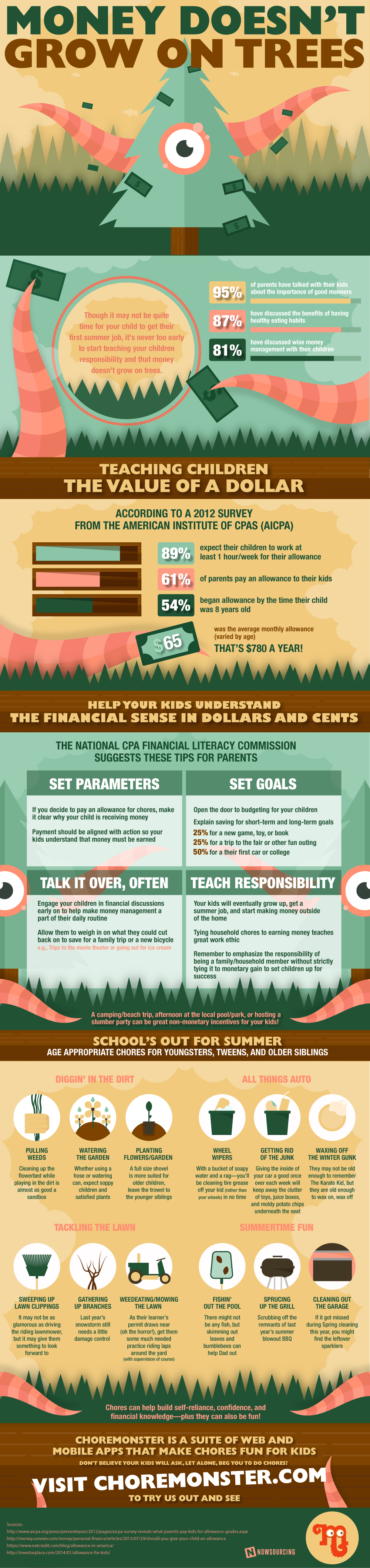

Have a look at this infographic by ChoreMonster, an app that lets parents incentivize chores.

Give Them All the Necessary Info

No parent would be comfortable with their kids asking them questions like” how much do you guys make?” or “How much did you buy the house for?”, and there is no need to tell your kids how much you earn. Even if you feel compelled to answer them, figures like $50000 or $15000 are not very meaningful to kids, instead tell them if you can or you cannot afford something.

Comments are closed.